Initiating the relationship.

Initiating the relationship is the largest hurdle to overcome because there are many nuances you need to consider when looking at new carriers. Before reaching out, prepare yourself by completing the three following steps.

-

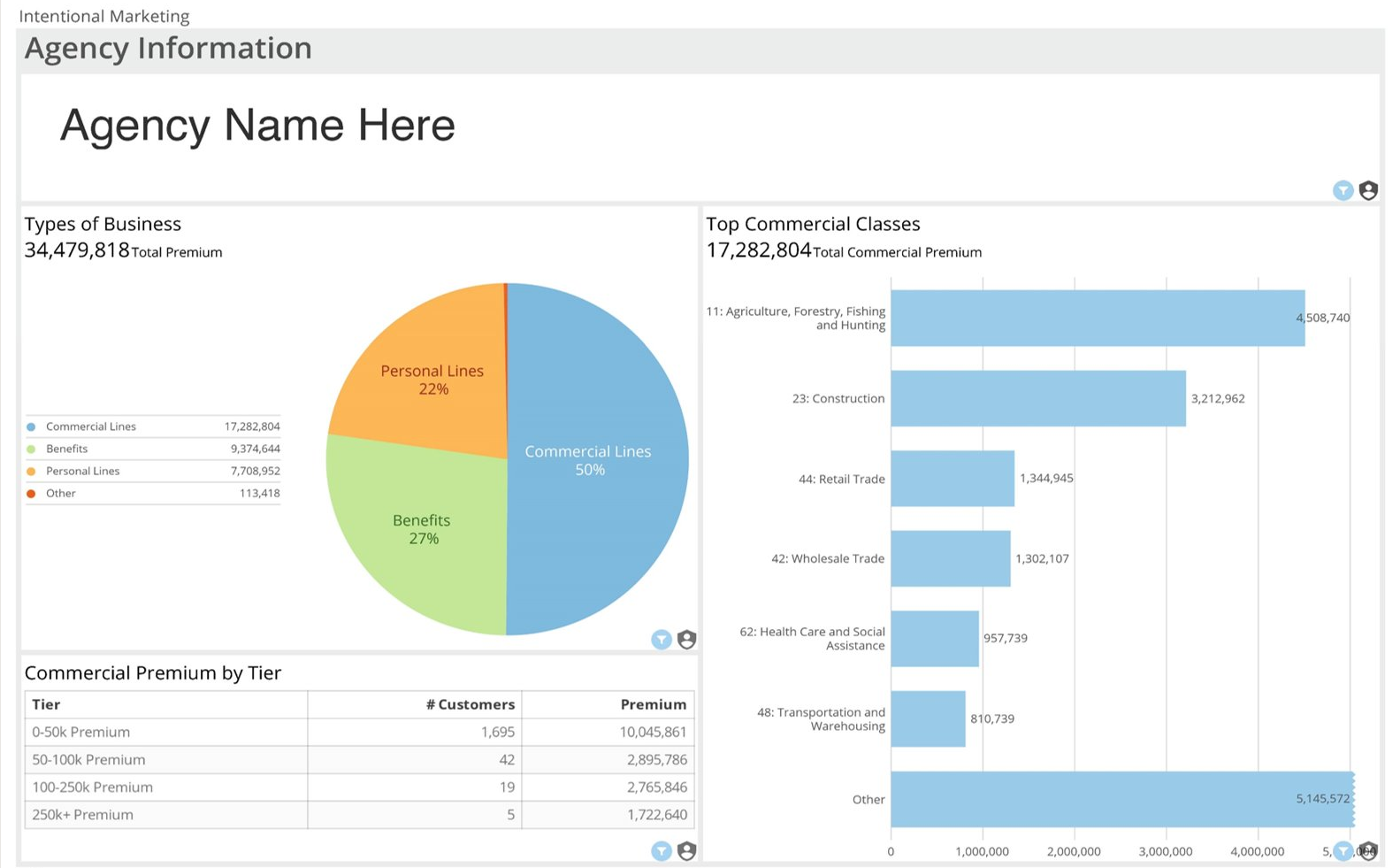

Evaluate your current resources and capabilities. You can think of this step as a way of proving your credibility to a carrier. Include:

- Your current carrier relationships

- Industry expertise (SIC or NAICS)

- Centers of influence

- Current carrier and broker contracts

- Volume by industry, carrier, and broker

- Average account size

- Your producers and account managers

-

Identify the opportunities you’re offering the new carrier and set objectives to show how you plan on fulfilling them. Answer these questions:

- What are the industries you’re targeting? It’s especially effective if they are underserved.

- What geographic areas are you targeting? There should be enough interest and opportunity in a given area to make it worthwhile for a carrier to partner with you.

- What size of account do you plan on targeting? It may not be worth the effort on the carrier’s part to work with you if you plan on consistently writing small accounts.

- Who are the producers and account managers that will be working with the carrier? Both producers and account managers should have the knowledge and capacity to successfully leverage a new carrier’s products.

- How much product interest exists? If a carrier’s products don’t fill the niche of your targeted areas and industries, it’s not worth the carrier’s time to work with you.

-

Develop an agency business plan based on the priorities and objectives you identified in step two. The purpose of the agency business plan is threefold:

- Helps the carrier guarantee that you’re aligned to similar goals.

- Allows you to monitor and measure your success.

- Demonstrates to the carrier that you know exactly what you want and how you plan on achieving it.

Growing and maintaining relationships.

Growing and maintaining a carrier relationship is easier than starting one because there’s more leeway in maintenance. However, that doesn’t make it any less important.

At an agency level, once you have an appointment with a carrier, your focus switches to your underwriter. You know that you can’t always choose an underwriter to work with, so it’s essential you keep in good standing with them.

One of the best ways to keep your underwriters happy is to provide as much detail as possible along with all the necessary information when submitting a new policy application to them. It makes life easier for the underwriter and creates a more efficient pipeline overall.

At Leavitt Group, we have our own approach to maintaining and creating new carrier relationships. Because we’re a larger company, we can lend an additional sense of credibility to our agencies. We also have an appointed council, made up of C-suite members, whose primary role is to build direct personal relationships with insurance carriers that benefit our agencies and their insurance advisors.