Only 3-13% of business owners change their broker every year. Clearly, this percentage is small. Very few people are actively looking for a change to their insurance program because they see it as a messy and chaotic process.

Your goal, as an insurance producer, is to educate clients about the insurance process and show them the process doesn’t need to be chaotic.

Keep in mind that the sales process isn’t fast. In the insurance industry, sales ultimately come down to long-term relationship building with prospective clients.

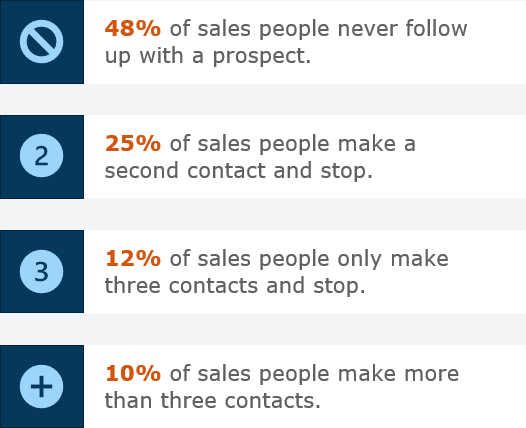

Around 80% of sales aren’t made until the 5th to 12th contact. If you approach your prospective clients in the first meeting with the traditional mindset of giving them a quote, the metaphorical door will close in your face.

You need to be different. So, what are you doing that’s different?

Leavitt Group’s Holistic 5-Step Sales Process

1. Creative Prospecting

Your message and persona are critical when approaching a new prospect for the first time. Your first impression will last, regardless of whether it’s good or bad.

At Leavitt Group, we encourage producers to take an alternative stance when approaching a new prospective client. Instead of offering a quote, we suggest the following.

“I’m not here to quote your insurance. That hurts you as a buyer.”

This statement makes people stop because it’s different and gets them thinking. It simultaneously provides you the opportunity to educate them about ‘the man behind the curtain.’ By approaching someone with this statement, you provide them with a subtle invitation into the next step in the sales process – the initial meeting.

2. Initial Meeting

The initial meeting with a prospective client should never be more than 15 to 20 minutes, and you must tell your prospect this very thing. Your goal is to build their trust, and sticking to your promise is one of the best ways to do this.

Before going in, you should have three things ready: an agenda, a toolbox visual, and a case study.

- Agenda: Since you only have 15 to 20 minutes, you want a clear idea of how the meeting should go. It’s also vital you emphasize to your prospective client that this meeting will not be about quoting insurance.

- Toolbox visual: With a “roadmap” of the insurance process, you can better walk them through the entire insurance buying journey. You can also show them areas where their current broker possibly hasn’t explored to help them save money.

- Case study: A case study provides evidence that you know what you’re doing and shows them you understand how to work with clients in similar situations. You also need to make sure to align your examples to your customer to make sure they resonate.

Your goal at this step of the sales process is to schedule another, longer meeting. Keeping the initial meeting short helps towards this goal because you can’t explain everything in only 15 minutes. If they want to know more, then you set up another, longer meeting with them.

As you set up a follow-up meeting, ensure that your prospective client shares who their company’s decision-maker(s) are, and open the invitation to them as well. We can’t stress enough how vital it is for decision-makers to be there.

Before the next meeting, encourage them to think about what their current broker is doing for them. Has their broker pulled the financial levers you’ve shown them?

3. Discovery

The discovery stage occurs before and during the 60-to-90-minute meeting that comes after the initial meeting. In this phase, you have to do your best to learn your prospective client’s story, including their:

- Risk tolerance

- Loss analytics

- Exposure mitigation

- Non-insurance transfer

Another goal of the discovery phase is creating doubt in their minds regarding their current broker. However, you should never say anything negative about their current broker — your current competition. Doing so generally comes across as crass and does not paint you in a classy light.

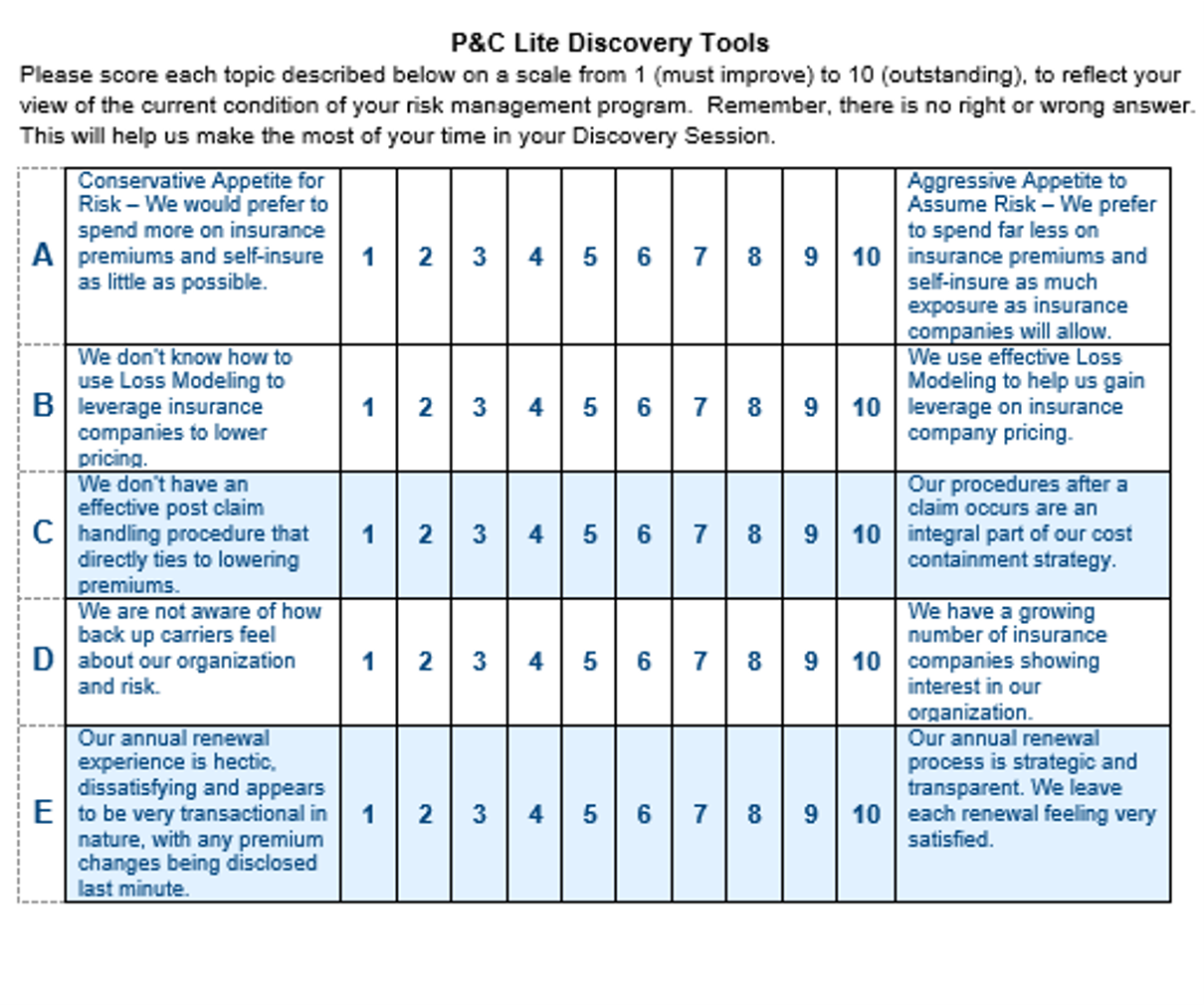

One of the best ways to create this doubt is by bringing along a scorecard.

Scorecards are meant to be completed by your prospects. They’re comprised of just a few questions intended to get them thinking in-depth about whether they have the right program. In essence, a scorecard opens your prospective clients’ eyes while simultaneously giving you an idea of what they want.

Understanding the needs and history of your prospective client are essential to genuinely acting as a consultant and advocate. You need to paint them in the best possible light to underwriters. Ask questions and explore all the different reasons they have for their answers.

To put them and yourself in a position for success, walk away from the “discovery” meeting with:

- Your prospective client’s current policies

- Their loss history and runs

- Any contract and business associate agreements they have with vendors

- NCCI or WCIRB worksheets

Your next step is synthesizing the information you’ve gathered and creating a roadmap of possibilities for your prospective client.

4. Roadmap Presentation

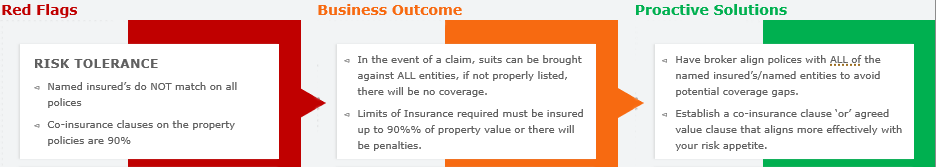

The roadmap presentation is your time to shine. At this point, you’ve taken the information your prospective client gave you during the discovery phase, and you’ve found solutions to their problems — whether they knew about said problems or not. It’s time to present these red flags to them.

By showing them any existing red flags, you're putting pressure on their current broker because they haven't mentioned any of what you're presenting. That said, be careful to walk a fine line during this portion of the roadmap presentation. You don’t want anyone to feel belittled or stupid.

Don’t give away all the problems or contradictions you’ve found. You want to give them a taste of doing things differently — only present 5 to 8 red flags, each issue's outcomes, and a potential solution.

You are a problem solver, not just a problem finder.

With each issue and solution you present, give the meeting participants a chance to let the information sink in. Try asking them whether they were aware of the issue in the first place and let them ask questions they may have.

You may be worried your prospective client will walk away from this meeting and bring their concerns to their current broker for fixing. It’s a valid concern.

You’re allowed to ask them that they don’t share this information with their current broker. Alternatively, you can pitch all of this as a value-added solution they will get with you as their broker, because their current one certainly hasn’t said anything.

5. Closing the Deal

At the end of your roadmap presentation, you have the opportunity to close the deal. There are two ways you can do this.

- “Make us your broker for this problem right now, and we can hit the ground running.”

- “Pay us an annual fee, and we’ll act as your official advisor while you keep your current broker.”

Regardless of how you choose to close the deal, make sure to emphasize the value you alone bring to the table. Closing the deal is the culmination of all your previous work.

If you’ve followed the process correctly, you are more likely to gain a new client because you’ve shown them you’re competent and that you care.