Your Trusted Partner Across the Nation

Leavitt Select Insurance Services is licensed in all 50 states. We’re equipped to serve you with top-notch coverage, from coast to coast.

CA License #369712

Call: (801) 308-1401

Get a Quote Online · or call: (801) 308-1401

Leavitt Select Insurance Services is licensed in all 50 states. We’re equipped to serve you with top-notch coverage, from coast to coast.

CA License #369712

As a medical professional, you are legally responsible for correctly and accurately diagnosing, treating, and caring for your patients.

You are good at what you do, but it’s important to keep yourself safe in the event something goes wrong.

Protect yourself with a medical professional liability insurance policy from Leavitt Select Insurance Services.

You may have heard other names for this type of insurance such as medical liability insurance, malpractice insurance, and medical malpractice insurance. Regardless of what term is used, medical malpractice insurance provides a second line of defense if you are faced with a malpractice lawsuit.

Some coverage options include the following:

Medical malpractice insurance is essential for anyone who provides healthcare services. However, there are a few nuances to keep in mind.

You may be covered under your employer. However, this coverage will have limitations, so make sure to find out what these limitations are from your local Leavitt Select Insurance Services insurance agent. It may be a good idea for you to have a policy separate from your employer.

If you are a medical professional employed by the U.S. government, you do not need a malpractice policy. You are insured against liability claims by the federal government.

If you are an independent contractor, you need medical liability insurance. It is unlikely you are covered by your employer, and you need coverage to keep yourself safe.

Additionally, it’s not just physicians and surgeons who need medical liability insurance. Other medical professionals can benefit from coverage, including:

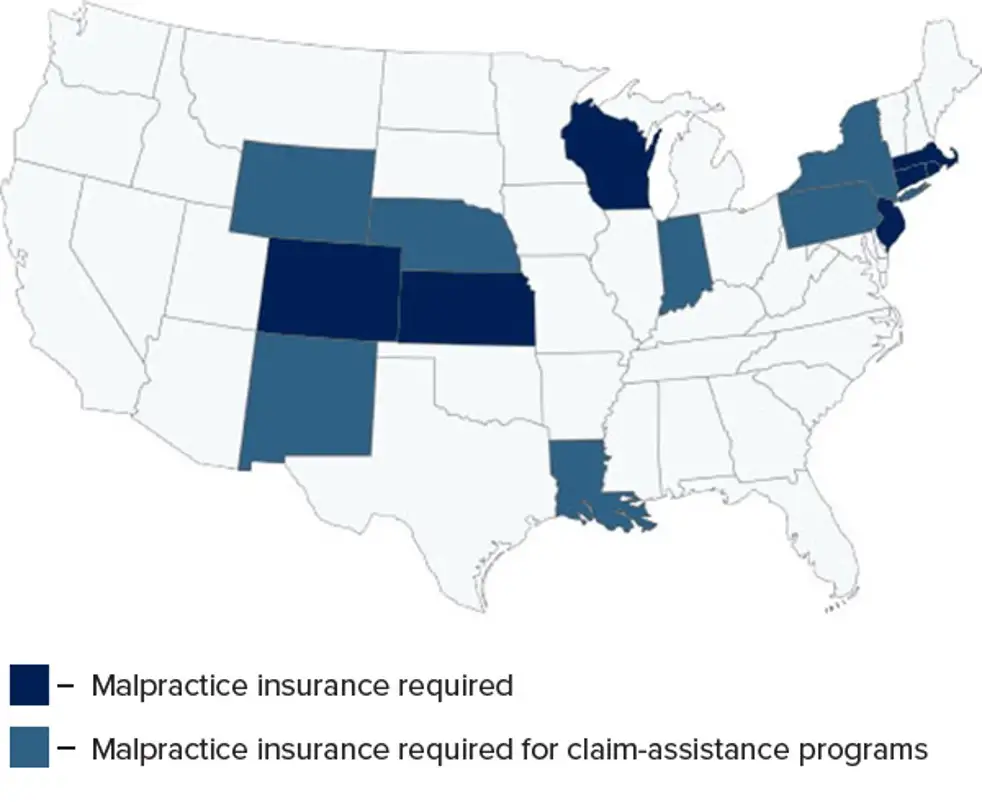

There isn’t an easy answer to this question because medical professional liability insurance requirements vary from state to state.

If you employ other medical professionals, you should consider maintaining a vicarious liability insurance policy. This coverage can protect your practice against any actions or omissions of your employees.

You are liable for any damages caused by violations of HIPAA laws. However, these damages are not covered by medical malpractice insurance. You can read more about protecting your practice from cybercrime, one of the top risks leading to HIPPA violations.