Let’s be honest. You know you need workers compensation insurance, but it’s not something you want to spend time thinking about. You have other things on your mind that feel far more important than knowing the ins and outs of workers compensation insurance.

Trust me, I understand. However, I’m here to tell you those ins and outs are more important than you think. Many business owners think it’s an uncontrollable cost and out of their hands when it really isn’t.

To be brutally honest, you can be driven out of business if your workers comp premium gets out of hand. Taking back control begins with understanding how workers comp insurance works.

What is an eMod?

You can trace most, if not all, of your workers compensation woes back to your eMod, which is a rating number that represents the level of risk your company poses as compared to similar companies in your industry and area. It functions a lot like your personal credit score.

Many factors go into your eMod’s calculation, but there are only two factors you can control directly: your workers comp payrolls and workers comp claims payments.

How do eMods work?

Now you know what your eMod represents, but you may still wonder how it affects you. It’s a good question!

Your eMod score is a 3-year rolling history that fluctuates annually based on your payroll and claims history. An eMod of 1 means your company maintains an average level of risk.

An increased eMod means your company sees a higher-than-average claims amount. Vice versa, a decrease to eMod means you have a lower-than-average claims amount. When your eMod increases, there is an increase, or debit, to your premium. When it lowers, you receive a credit to your premium and thus pay less.

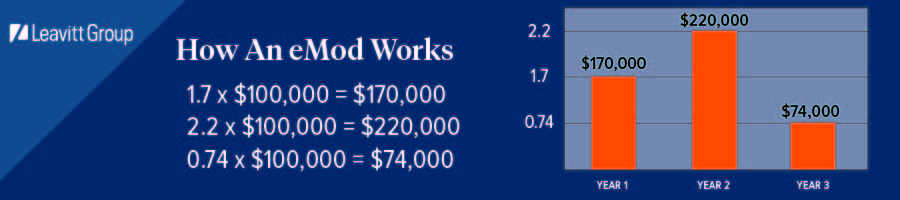

With all this “debit and credit” talk, you may have figured out eMods are tied directly to a monetary value. An eMod is a multiplier that affects the premium a company like yours pays for workers comp. If the “average” company in your industry has an eMod of 1 and is expected to pay $100,000, for every tenth and hundredth your eMod increases or decreases, your workers comp premium will increase or decrease.

Here’s how a change in EMOD works. (Spoiler, it’s pretty easy.)

Why does lowering my eMod matter?

I’ll answer this question with a story.

I once had a client come to me with an eMod of 2.11. The client was literally about to go out of business because they couldn’t afford their premium.

Fortunately, I was able to help them decrease their eMod significantly from a 2.11 to a 0.67. Their workers comp costs decreased by hundreds of thousands of dollars.

Maybe you’re not at risk of being driven out of business, but lowering your eMod still helps from an income perspective as well. You have a wider profit margin when you pay less for insurance and other business expenses. It’s a given. A wider profit margin means you can offer more competitive bids to prospective clients.

Reducing insurance expenses increases your profit and overall improves your bottom line.

How do I lower my eMod?

Like anything else, it’s very easy to talk about lowering your eMod. In practice, things tend to be a little more complicated. It could be improving safety procedures, changing how you train employees, etc.

The process is different for everyone, and there’s more than one way to go about lowering your eMod. The major takeaway is that there are steps that you can take TODAY to reduce your eMod, and in turn your workers comp spending. Having a dedicated advisor who knows the industry and all the tips and tricks will make your life a lot easier.

When you’re ready to lower your eMod, I’m here for you. Let’s talk.