Warehouse / Logistics / Transportation

Bryan, El Paso, Houston - Briar Forest, Houston - Post Oak, Sugar Land - Greatwood, Tyler

We have the knowledge and experience to insure your warehouse operations and help protect you from exposures.

Request Quote or Contact Us

Please note: coverage cannot be bound or altered online. A service representative will need to contact you to finalize your request.

What You Need to Know About Warehouse / Logistics / Transportation

Do I need warehouse insurance?

Whether you need warehouse insurance ultimately depends on your business’s ability to recover from financial loss. You can do a fast self-diagnostic by asking yourself the following questions:

- Can you afford to replace your clients’ lost property?

- If a client or prospect is touring your facility and is injured, can you afford their medical bills?

- Do you know the exact value of the items you’re storing?

If your answer to any of the above is no, then you may consider purchasing insurance for your warehouse.

What insurance does my warehouse need?

There are many coverages you can purchase, but there are a few types that can be beneficial for all warehouses.

-

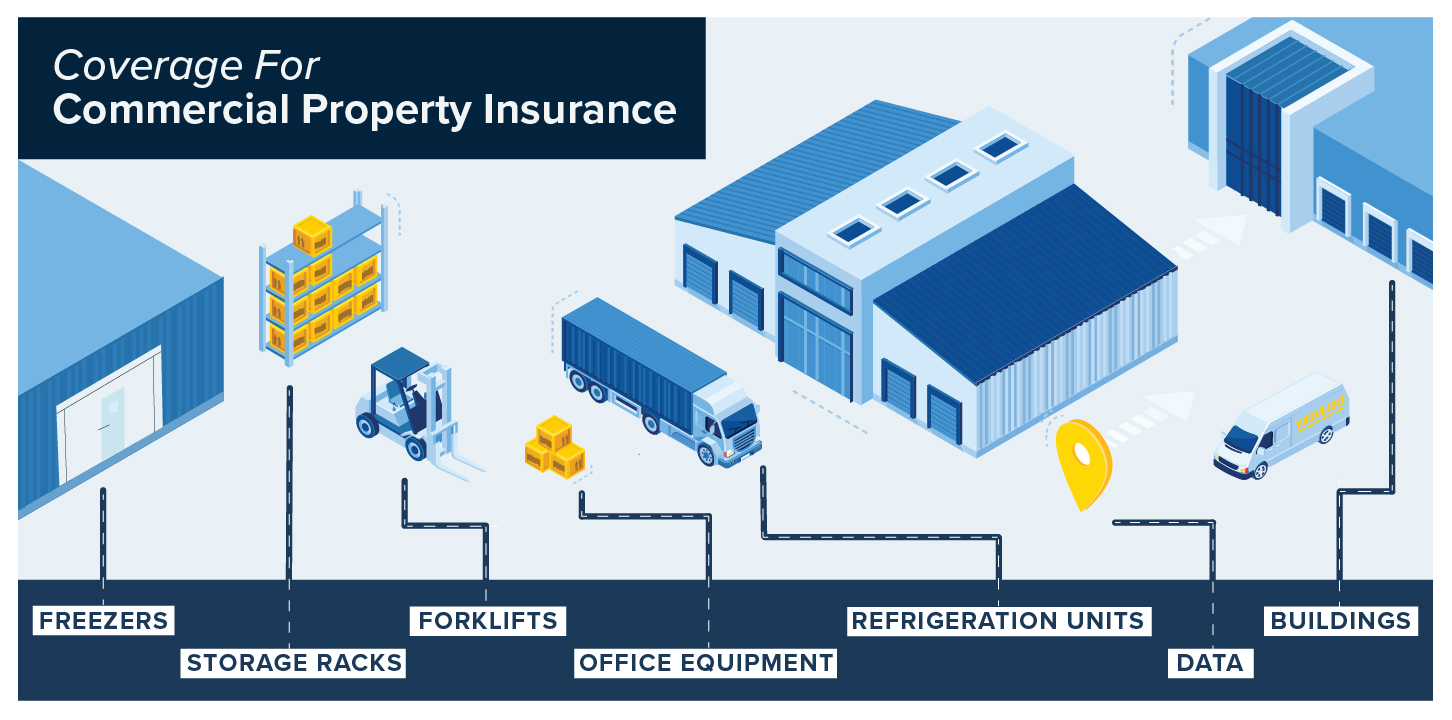

Commercial property

The success of your warehouse business relies on the property associated with it. If disaster hits and your business’s property is damaged by fire, weather, smoke, or humidity or temperature changes, commercial property insurance can offer you a financial safety net. Examples of assets covered by commercial property insurance include:

-

Workers Compensation

If any employees are injured or become ill on the job, this insurance can cover the payment of their medical expenses, lost wages, and rehabilitation costs.

-

General Liability

Protects your company against bodily injuries, property damage, product damage, copyright violation, legal costs, and more.

-

Commercial Auto

Even if you use a personal vehicle for work, a personal auto insurance policy doesn’t cover the car while it’s being used for work purposes.

-

Inland Marine

If you have a transportation arm of your company, you should consider inland marine insurance. A commercial auto insurance policy does not cover any client goods and products you transport, which is where inland marine insurance takes effect.

What is warehouse legal liability insurance?

Warehouse legal liability insurance — also known as warehousemen’s legal liability or warehouse operators legal liability insurance — is a special type of liability insurance that safeguards against inventory loss and property damage due to employee negligence or lack of facility maintenance.

Some examples of risks covered by warehouse legal liability insurance include:

- Product damage due to careless handling and storage practices

- Inventory damage because of poor or negligent climate control

- Theft of client goods

- Lost or missing items

- Services your warehouse provides, including packaging, assembly, kitting, and cross-docking

- Loss resulting from infestation

- Fourth-party warehouse arrangements

What if there is a fire in my warehouse?

Coverage options to look for:

Fire Damage: The primary coverage provided by this policy is for damage or destruction of the warehouse and its contents due to fires. This includes damage caused by flames, smoke, heat, and even water used to extinguish the fire.

Property Loss: Warehouse insurance typically covers the loss or damage to the physical structure of the warehouse, as well as the inventory, equipment, and other assets stored within it - affected by a fire. This coverage helps with repair or replacement costs.

Business Interruption: In case the warehouse becomes unusable due to a fire, this insurance can also cover the loss of income or additional expenses incurred during the downtime. This ensures that the business can continue operating, even if temporarily relocated.

Liability Protection: Some policies may include liability coverage in case a fire in the warehouse spreads to neighboring properties, causing damage or injuries. It can also cover legal expenses if someone sues the warehouse owner for fire-related damages.

Debris Removal: This policy often includes coverage for the removal and disposal of debris resulting from the fire, making it easier to clean up and rebuild.

As professionals in the field of warehouse insurance, we make it our business to know you and your concerns. We spend time learning and listening to better serve you, our clients.

You’ve worked hard to build your warehouse operation. The next step is to protect it. We’ll assess what your risks are and help you tailor an insurance policy.

We’d love to chat with you. Contact us today!

We improve our products and advertising by using Microsoft Clarity to see how you use our website. By using our site, you agree that we and Microsoft can collect and use this data. Our privacy statement has more details.